Tax Brackets Meaning . Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. See the updated 2023 tax. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system.

from www.financestrategists.com

Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. See the updated 2023 tax. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied.

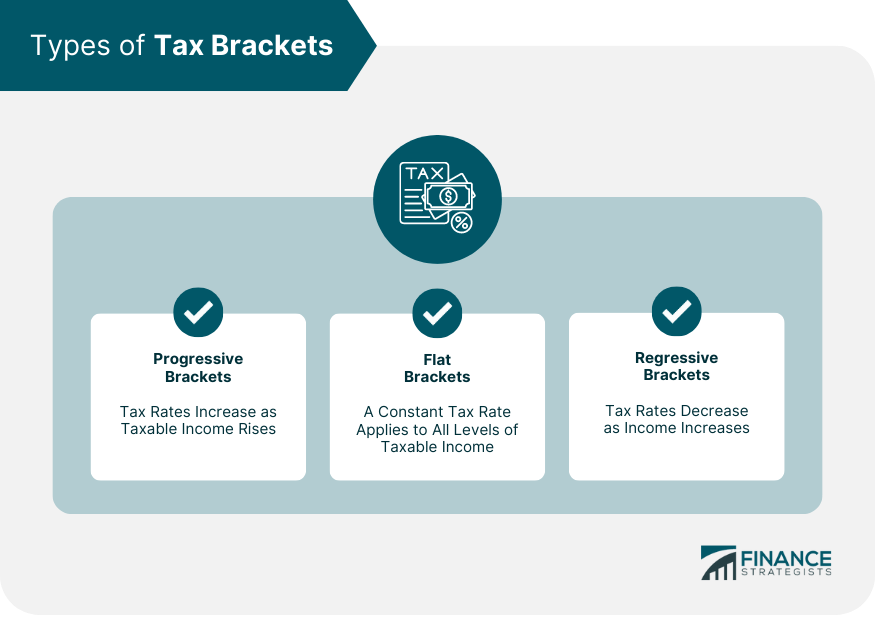

Tax Brackets Definition, Types, How They Work, 2024 Rates

Tax Brackets Meaning See the updated 2023 tax. Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. See the updated 2023 tax. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total.

From beaconwc.com

Beacon Wealthcare 2023 Contribution Amounts, Tax Bracket Changes, and Tax Brackets Meaning Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web learn how tax brackets determine the tax rate you pay on each portion of your income. Tax Brackets Meaning.

From www.youtube.com

Tax Brackets Explained in 5 Minutes! YouTube Tax Brackets Meaning Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web learn how. Tax Brackets Meaning.

From chrismenardtraining.com

Tax Brackets Explained using Excel's XLOOKUP function Chris Menard Tax Brackets Meaning Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. Web. Tax Brackets Meaning.

From www.theadvertiser.com

How tax brackets affect what you pay in taxes Tax Brackets Meaning Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the. Tax Brackets Meaning.

From www.hotzxgirl.com

Usa Tax Brackets Hot Sex Picture Tax Brackets Meaning See the updated 2023 tax. Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from. Tax Brackets Meaning.

From medium.com

How Tax Brackets Work and Why Going Up a Tax Bracket Will Never Tax Brackets Meaning Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. Web tax brackets specify the tax rate you will pay on each portion of your taxable income. See the updated 2023. Tax Brackets Meaning.

From www.pinterest.com

How Tax Brackets Work [2022 Tax Brackets] White Coat Investor in 2022 Tax Brackets Meaning Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to. Tax Brackets Meaning.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know Tax Brackets Meaning Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending. Tax Brackets Meaning.

From splashline.online

Tax brackets and rates for 2023 explained Splashline Tax Brackets Meaning See the updated 2023 tax. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web tax brackets specify the tax rate you will. Tax Brackets Meaning.

From www.dreamstime.com

Business Concept Meaning Tax Brackets 2020 with Phrase on the Sheet Tax Brackets Meaning See the updated 2023 tax. Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web to achieve greater progressivity, the. Tax Brackets Meaning.

From www.youtube.com

Tax bracket what is TAX BRACKET meaning YouTube Tax Brackets Meaning Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web tax brackets are ranges of taxable income, each corresponding to a different percentage. Tax Brackets Meaning.

From www.wallstreetmojo.com

Tax Bracket Meaning, Explained, Examples, Vs Effective Tax Rate Tax Brackets Meaning See the updated 2023 tax. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web to achieve greater progressivity, the top marginal personal income tax rate. Tax Brackets Meaning.

From www.youtube.com

Tax bracket meaning of Tax bracket YouTube Tax Brackets Meaning Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on. Tax Brackets Meaning.

From diversifiedllctax.com

Tax Brackets for Your 2022 Taxes Diversified Tax Tax Brackets Meaning Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web tax brackets are ranges of taxable income, each corresponding to a different percentage. Tax Brackets Meaning.

From www.investopedia.com

20232024 Tax Brackets and Federal Tax Rates Tax Brackets Meaning See the updated 2023 tax. Web learn how tax brackets determine the tax rate you pay on each portion of your income in a progressive income tax system. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. Web a tax bracket is the range of incomes taxed at given rates, which typically differ. Tax Brackets Meaning.

From africa.businessinsider.com

Here's how to find how what tax bracket you're in for 2020 Business Tax Brackets Meaning Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web tax brackets specify the tax rate you will pay on each portion of. Tax Brackets Meaning.

From www.schwab.com

How Do Tax Brackets Actually Work? Charles Schwab Tax Brackets Meaning Web a tax bracket is a tax rate for a range of incomes, as shown on a table created by the irs to indicate the total. Web to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. Web tax brackets are ranges of taxable income, each corresponding to a different percentage. Tax Brackets Meaning.

From peavyandassociates.com

Understanding Tax Brackets Peavy and Associates, PC Tax Brackets Meaning Web tax brackets specify the tax rate you will pay on each portion of your taxable income. Web tax brackets are ranges of taxable income, each corresponding to a different percentage being applied. Web a tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. Web learn how tax brackets determine the. Tax Brackets Meaning.